It’s commonly known that the bigger your deposit, the smaller your home loan, and thus, the lower your monthly repayments. But today we’ll look into another way your deposit size could reduce your repayments: by potentially reducing your interest rate.

Continue reading “How your deposit size can shape the rate you pay”The pros of having a mortgage broker on your side

What exactly can a mortgage broker do for you? Well, we don’t mean to toot our own horn, but we can make your home loan journey a whole lot easier, letting you focus on the fun part: planning for your new home!

Continue reading “The pros of having a mortgage broker on your side”5 New Year’s resolutions for your home loan

Thought of a New Year’s resolution yet? Or perhaps you’ve broken one already? Either way, check out our list of possible mortgage goals for 2024 – try one, or have a go at them all – to save a bundle in the year ahead.

Continue reading “5 New Year’s resolutions for your home loan”Merry Christmas! Season’s greetings from all of us to you

The year has flown past, and as our thoughts turn to trees, tinsel and turkey, we’d like to thank all our fantastic clients for your support throughout 2023.

Continue reading “Merry Christmas! Season’s greetings from all of us to you”Ho ho ho! The smart move that has 1 in 10 borrowers feeling jolly

Home owners have been battling rising interest rates for over a year and a half now. But a new report reveals the important step some savvy borrowers are taking to rein in higher rates and swap “oh no!” for “ho, ho, ho!”.

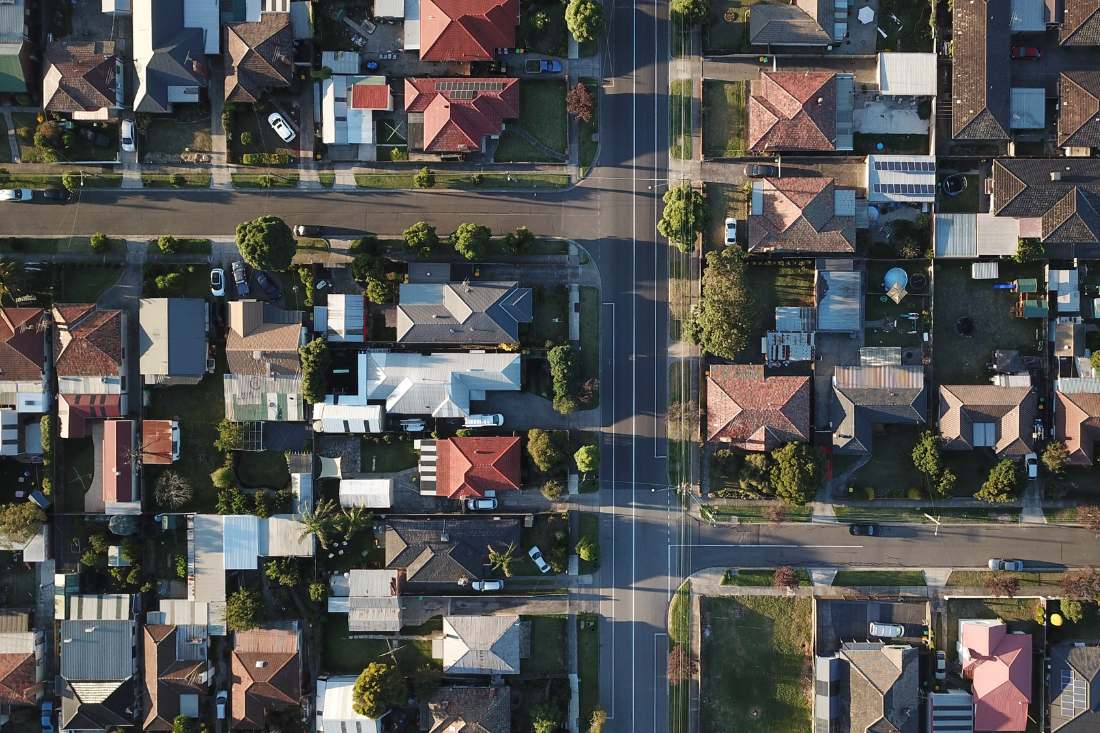

Continue reading “Ho ho ho! The smart move that has 1 in 10 borrowers feeling jolly”What’s tipped for house prices in 2024?

If buying a home is at the top of your wish list for 2024, don’t miss our rundown on how the property market has fared in 2023 – and why the new year is shaping up as potentially another big year for real estate.

Continue reading “What’s tipped for house prices in 2024?”More lenders sign up to low deposit first home buyer scheme

First home buyers with a small deposit now have an even wider range of lenders to choose from. We reveal the latest banks to join the 5% deposit scheme that’s helping more buyers get into the market sooner.

Continue reading “More lenders sign up to low deposit first home buyer scheme”How to manage your home loan over Christmas

It may be called the silly season but a few smart strategies could help you enjoy the festive season this year without missing a beat on your home loan. Check out our tips to share the Christmas cheer this year without breaking the bank.

Continue reading “How to manage your home loan over Christmas”The big stretch: should you extend your loan term?

If the November rate hike will seriously stretch your finances, one potential solution may be to extend your loan term. It can ease the hip pocket pain by lowering monthly repayments. But taking more time to pay off your mortgage can come with hidden downsides. Here’s what to weigh up.

Continue reading “The big stretch: should you extend your loan term?”RBA increases the cash rate by 25 basis points, up to 4.35%

The Reserve Bank of Australia (RBA) has increased the official cash rate by 25 basis points, taking it to 4.35%. So just how much will this year’s Melbourne Cup day rate hike increase your monthly repayments?

Continue reading “RBA increases the cash rate by 25 basis points, up to 4.35%”